Change in the Cheverly Market?

October 7, 2015

Of course, I have no idea what will happen tomorrow, much less next month or next year, but I am keeping an eye on a trend that seems to be taking shape. One month does not a trend make, but it will be interesting to watch the market over the winter and into the spring.

Cheverly Active Listings vs Pendings per Month[/caption]

Cheverly Active Listings vs Pendings per Month[/caption]

The tall orange column (September 2015) all the way to the right shows 20 active listings (Actives), a number that was fairly consistent throughout the month of September. The blue column is the number of contracts that were accepted (Pendings). In a nutshell, we haven't had this many houses on the market since July 2011. Coinciding with record high actives, the pending have remained fairly constant. The result is that we have a surplus of homes on the market for the first time in years.

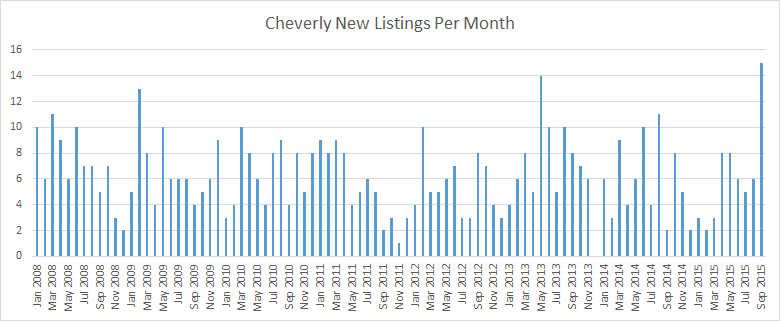

Cheverly New Listings per Month

Cheverly New Listings per Month

Next, look at how many new listings came on the market in Cheverly each month. Again, that last column is September 2015. We had a whopping 15 properties come on the market. The last time we had that many houses come on the market in one month was before the market surged 10 years ago. On top of that, it is rare to have an increase like that in the fall - most of the peaks have been in spring months.

Analysis

Here is what I think is happening. We have had a shortage of homes on the market since the recovery started. There have been consistently more buyers in competition for those homes. Why the shortage of homes on the market? Many sellers have been upside down since the market crashed, and have been waiting for the market to recover enough for them to break even or make a small profit.

For most of those sellers, they feel this recovery happened this Spring. But most weren't ready to go on the market. As a few houses sold in the high $300s and even into the $400s, many of those sellers figured that they'd jump on the bandwagon. However, the increase in houses coming on the market has actually changed the market, because the number of buyers hasn?t increased.

Prediction

This is actually a normal market, this surge and fall back pattern. We just haven't seen one in a very long time. Government shut-down threats don't help. If you're willing to price the house where the market is now, rather than projecting a higher price based on the 2015 Spring market, you'll do fine.

I predict that if the number of actives drops in any significant way, it will be due to sellers deciding to withdraw their homes from the market and wait until later. I think many of the current sellers are going to be disappointed by lackluster activity on their homes (mostly because they priced their houses too high), will take their houses off the market for the winter and will put them back on in the Spring. I also think we're going to see a surge in new listings in the Spring for the same reason. This may also have the effect of keeping prices more stable.